Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

mltv

Member

GM Makes Self-Driving Bet In China To Catch Up With Nio, Xpeng

General Motors will invest in Chinese self-driving startup Momenta, as key new Nio, Xpeng EVs loom. GM stock rose.

Tesladaily will do it no doubt.If this is accurate/true......anyone willing and have the time to do the math to figure out Sept production? We have production numbers all the way up through Aug now, so we should be able to calculate at least somewhat close.

Artful Dodger

"Neko no me"

If this is accurate/true......anyone willing and have the time to do the math to figure out Sept production? We have production numbers all the way up through Aug now, so we should be able to calculate at least somewhat close.

Rob Maurer maintains a spreadsheet with China P&D data. I'm sure it'll be on his daily report soon.

@The Accountant may have the data as well.

ZachF

Active Member

TheTalkingMule

Distributed Energy Enthusiast

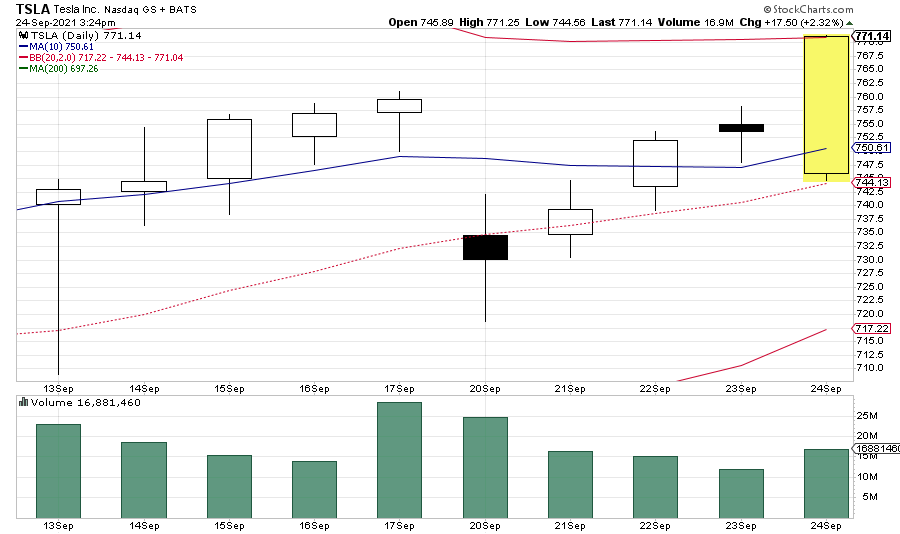

Pesky volume keeps popping up! This float is tight as a mofo, the next 4 weeks should be delightful.

Deleting all option sell orders and will re-evaluate next week

Deleting all option sell orders and will re-evaluate next week

woodisgood

Optimustic Pessimist

Interesting anecdotal incident from the self-driving wars here in SF:

My wife, as a pedestrian waiting to cross, observed a GM Cruise vehicle make an unprotected left through a red light. There were screeching brakes as the perpendicular traffic had to avoid a crash. She said it looked like the driver took over emergently (but acknowledged it was possible the driver could have been driving the whole time and made the mistake him/herself).

My wife, as a pedestrian waiting to cross, observed a GM Cruise vehicle make an unprotected left through a red light. There were screeching brakes as the perpendicular traffic had to avoid a crash. She said it looked like the driver took over emergently (but acknowledged it was possible the driver could have been driving the whole time and made the mistake him/herself).

StealthP3D

Well-Known Member

Somebody already posted this video, but something about Mayur’s focus on ROIC and comparison of Tesla’s 23% to Apple’s 40% bothered me and I believe I figured it out.

ROIC on EXISTING (already deployed) capital (like Apple) is not that pertinent.

E.g. Assume another company (Apple Prime) has 2.5X more capital deployed than Apple but only has a 20% ROI vs Apple’s 40%, but is identical in every other way. Apple Prime should be more highly valued, because the cash flow would be greater.

Apple OBVIOUSLY cannot get a 40% ROI on NEW capital deployment, because if they could, they would immediately halt buybacks, dividends, deplete their bank account and borrow as much as possible to invest that new capital at a 40% rate of return

So ROEC (Return on existing capital) is just not important. Nobody cares about how much capital you had to deploy to get your present cash flows. Only the size of the cash flows and your present debt/cash balance matters.

So while Tesla has 23% ROEC, that’s not important. What IS important is their RONC (Return on New Capital).

Supposedly GF Shanghai Phase 1 only cost $1B. At 250k units per year and $10k gross profits / unit, that’s a staggering 250% gross profit return on that capital. I would imagine net cash flows from that factory would be a huge portion of that as OpEx shouldn’t be that high for that factory alone and/or China operations. Note: I believe GF Berlin and Austin are not that cheap, so I wouldn’t expect that RONC.

So RONC is one of the largest determinants on growth rate. And it is growth rate that is important! I believe Mayur mentioned legacy auto gets 10% RONC, but since new capital costs them 10%, they have no motivation to expand.

So ROEC is an historical measurement that is only important in so far as it helps predict RONC, which is EXTREMELY important as well as the total addressable market which helps decide how long a very high RONC can continue. In Tesla’s case, the addressable market for transport and energy is GIGANTIC, so they have a huge runway, which becomes infinite if they solve TeslaBot.

I don't think Mayur would disagree with most of what you wrote. He was only using return on existing capital as a way to project returns on future capital. Tesla's position is such that I do believe they will be able to increase their ROIC going forward, allowing for a pause in that increase due to the two more expensive and larger Gigafactories. That scale will take some time to maximize returns by ramping production over a multi-year period but the effect should be very positive on ROIC, maybe even astounding.

The Accountant

Active Member

I believe my numbers are all CPCA reported but I have not double checked.If this is accurate/true......anyone willing and have the time to do the math to figure out Sept production? We have production numbers all the way up through Aug now, so we should be able to calculate at least somewhat close.

I get 43,701 in Sep to reach 300k year-to-date. The 300k car is as of the 29th - so one more day until the 30th may get to 45k.

Artful Dodger

"Neko no me"

... and there goes the Upper-BB too. Now let's see how much technical selling that triggers:

Off Shore

Off Topic Member

Indictments.I wonder from time to time, what would happen if we (TMCers) organized buy orders at critical resistance points?

Just thinking out loud…

TheTalkingMule

Distributed Energy Enthusiast

QQQ is red by the bye. How about a nice little spike to $780 to close out a wonderful day?

Artful Dodger

"Neko no me"

Securement of Elons Capital? I was told the middle thing is always Elon ..We’d be investigated by the SEC

deshkart

Member

If button really rolls out today .. market will be forced to assign some value to FSD. Next question will be how fast will FSD get better. They can’t deny it as some Science project that will never be reality. Probably that’s why market is comfortable bidding TSLA higher today.

Spacep0d

Active Member

Man, I'm suddenly feeling better about buying a whole lot of stock (40k, a lot for me) at $717, $757, and thereabouts recently. I'm loving this spike!

Also, glad to hear that Elon thinks the chip shortage is temporary, and nice to see new chip factories coming up. Not sure if the Musk/Grimes separation will affect much but it sounds quite amicable. I guess it's good that they weren't married.

Last night I had a dream where Musk and I were talking at some kind of conference in front of a very large mural-sized window. Suddenly some fireballs were approaching as some transformers were blowing up in succession, rapidly approaching. He was going toward the glass and I said, 'Quick, under the desk!'. Next thing you know there are glass shards raining down all over the desk but we were unharmed.

Read into that as you will, lol. What does that say about me? Maybe don't answer in this thread.

Either way, glad to see the end-of-week spike after I sold my beloved P3D- to invest in MOAR TSLA! HODL THE DOOR!

Also, glad to hear that Elon thinks the chip shortage is temporary, and nice to see new chip factories coming up. Not sure if the Musk/Grimes separation will affect much but it sounds quite amicable. I guess it's good that they weren't married.

Last night I had a dream where Musk and I were talking at some kind of conference in front of a very large mural-sized window. Suddenly some fireballs were approaching as some transformers were blowing up in succession, rapidly approaching. He was going toward the glass and I said, 'Quick, under the desk!'. Next thing you know there are glass shards raining down all over the desk but we were unharmed.

Read into that as you will, lol. What does that say about me? Maybe don't answer in this thread.

Either way, glad to see the end-of-week spike after I sold my beloved P3D- to invest in MOAR TSLA! HODL THE DOOR!

Never doubt GM investments. They are really good at spotting and investing in companies with great technologies and high growth potential like Lordstown Motors or Nikola Motors.Looks like GM is full in geo-based solution. First with Cruise geofence solution now investing in local solution for self-driving in China instead on importing Cruise solution. More variety only mean added complexity to a solution. What will they do? having Cruise on vehicles for US and Momenta on vehicles for China? What about Europe? Or dumping Cruise?

GM Makes Self-Driving Bet In China To Catch Up With Nio, Xpeng

General Motors will invest in Chinese self-driving startup Momenta, as key new Nio, Xpeng EVs loom. GM stock rose.www.investors.com

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M