Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Thanks but I really don't need more margin

I still got close to a million of buying power left and I don't intend to use it

I'm reckless to a point

The reason why I'm carrying a $11million plus position in TSLA is because I have a sense of when to put pedal to metal and when to get the hell out of dodge

I could be totally wrong and today was the all time top but I highly doubt it

I used to be the sucker that sold at the bottom and bought at the top but after 19 years trading and millions in tuition to Wall Street I finally have a sense of when to push the limit and when to stay out

I do appreciate all the helpful information

You have so many millions, I can't even count it straight. So let's see, as it stands right now you have about 7mil net equity. You say you have been trading for 19 years with millions in losses over time. So I'm curious had you never done any trading at all and had all savings in cash what would your net worth today be?

Willuknight

Member

I was one of those that sold during the run up in 2013 thinking I could time the dips. I've learned my lesson. Core investment doesn't get touched. Trade some covered calls that then is used to play the market a little bit.

Yeah I sold all my shares at $230 up from $195, missed out on $280 and had to rebuild at $250. Not going to try that again.

MitchJi

Trying to learn kindness, patience & forgiveness

Don't encourage himYes please, I would be very interested to hear your mental model.

You should really consider moving your account to IB. The interest rate is lot lower and I believe you will get substantially more buying power. They have this so called 'portfolio margin' which gives you lot more buying power. I believe that works even when you have a concentrated position.

Last edited:

Today in the TSLA Technical Analysis thread one TMC member chided those who post technical analysis in other threads, while another member invited me to place my technical analysis in any thread I want. Normally I do place my technical analysis in the Tesla Technical Analysis thread. As a compromise I will simply note here that twenty minutes ago I added a post to the Tesla Technical Analysis thread: TSLA Technical Analysis

TrendTrader007

Active Member

ZeroYou have so many millions, I can't even count it straight. So let's see, as it stands right now you have about 7mil net equity. You say you have been trading for 19 years with millions in losses over time. So I'm curious had you never done any trading at all and had all savings in cash what would your net worth today be?

That's my net worth

It's all made up

I don't have any millions

I can make up any damn number out of the blue and post it online with no way for anyone to verify it

I can write that I have 3000 shares or 30000 or 60000 or 6 million shares

Why do you think I have to work 7 days a week

If I had millions do you think I'd be working 7 days a week

Okay since you're so damn curious about my net worth I'll tell you exactly

I have a total of 300 shares of TSLA

And 2 calls

I love to exaggerate my position by 100 times just to stoke my ego

End of discussion

(And I'm not wasting my time posting any philosophical discussions. I can think of 20 different things that I can do this evening rather than waste my time to explaining my net worth)

Have fun!!!

Last edited:

You mess with the bull, you get the horns.You can't be serious, are you?

I was asking genuinely.

AnneBoleyn

Anne Boleyn

Always better to err on side of caution and be less forthright.Thanks but I really don't need more margin

I still got close to a million of buying power left and I don't intend to use it

I'm reckless to a point

The reason why I'm carrying a $11million plus position in TSLA is because I have a sense of when to put pedal to metal and when to get the hell out of dodge

I could be totally wrong and today was the all time top but I highly doubt it

I used to be the sucker that sold at the bottom and bought at the top but after 19 years trading and millions in tuition to Wall Street I finally have a sense of when to push the limit and when to stay out

I do appreciate all the helpful information

AnneBoleyn

Anne Boleyn

Smartest post of the week. So glad you made it.Zero

That's my net worth

It's all made up

I don't have any millions

I can make up any damn number out of the blue and post it online with no way for anyone to verify it

I can write that I have 3000 shares or 30000 or 60000 or 6 million shares

Why do you think I have to work 7 days a week

If I had millions do you think I'd be working 7 days a week

Okay since you're so damn curious about my net worth I'll tell you exactly

I have a total of 300 shares of TSLA

And 2 calls

I love to exaggerate my position by 100 times just to stoke my ego

End of discussion

(And I'm not wasting my time posting any philosophical discussions. I can think of 20 different things that I can do this evening rather than waste my time to explaining my net worth)

Have fun!!!

JRP3

Hyperactive Member

Once again, as happens too often, the Market Action thread turns into the TT007 discussion thread. It's not relevant at all, I urge those of you so inclined to create a separate thread just to track his actions and keep the clutter out of this one.

I keep looking for the General Discussion bumps in the new posts list and often can't find them. Cause they keep winding up back in here.

If we're going to continue to have two threads, *please* take the inconsequential effort required to police yourselves. There is no valid excuse to be *so bad* at such a simple task. When someone (ahem, yours truly in this case) wants to catch up after a few days away, the unnecessary tedium is, well, unnecessarily tedious.

#makeTMCinvestorsforumgreatagain

If we're going to continue to have two threads, *please* take the inconsequential effort required to police yourselves. There is no valid excuse to be *so bad* at such a simple task. When someone (ahem, yours truly in this case) wants to catch up after a few days away, the unnecessary tedium is, well, unnecessarily tedious.

#makeTMCinvestorsforumgreatagain

UnknownSoldier

Unknown Member

I feel like this thread is often just the ValueAnalyst and TrendTrader007 show. There is a lot of useful discussion here nonetheless, so remember guys we're all here forever.

I just want to add that I've learned more from @TrendTrader007 posts than anyone else.Once again, as happens too often, the Market Action thread turns into the TT007 discussion thread. It's not relevant at all, I urge those of you so inclined to create a separate thread just to track his actions and keep the clutter out of this one.

I don't understand why folks care so much why he's invested "so much" in TSLA. Most of us here probably have a significant portion of our net worth invested in TSLA. The actual dollar amount doesn't matter.

bdy0627

Active Member

Nothing at all against Trendtrader007, but I'm guessing on the next substantial dip we have, you may wish you had learned more from some of the more conservative investors here who have lots of great info to learn from as well....

Nothing at all against Trendtrader007, but I'm guessing on the next substantial dip we have, you may wish you had learned more from some of the more conservative investors here who have lots of great info to learn from as well....

Let me elaborate a bit more. I've learned a great deal from a bunch of people here. And I am very grateful, as I've written in other posts. What TT007 did that I haven't seen anyone else do yet is explain in detail his observations on technical charts. From someone who knew very little from a technical analysis pov, that has been the most helpful. I'm not dogging on others' contributions. Just my experience.

MODERATOR NOTICE:

This is specifically to TT007: Make available your TMC account profile at once to permit "Conversations" or you will be either:

* Banned from posting on TMC, or

* Subjected to in-thread questions & discussions, and were you not to answer these open displays you will be banned regardless.

This notice goes more generally to ALL Investor Sector participants: You also need to ensure your TMC account profile is set so that you can participate in the "Conversation" mode; you also all must so comply or you too will face banishment if a Moderator attempts to initiate a Conversation but finds it blocked.

====> There is NO 'publicity' or any other kind of information leakage that occurs when a "Conversation" mode is set to open. It simply is an unfortunate glitch in the platform TMC uses.<=====

FIRST, LAST & ONLY WARNING

This is specifically to TT007: Make available your TMC account profile at once to permit "Conversations" or you will be either:

* Banned from posting on TMC, or

* Subjected to in-thread questions & discussions, and were you not to answer these open displays you will be banned regardless.

This notice goes more generally to ALL Investor Sector participants: You also need to ensure your TMC account profile is set so that you can participate in the "Conversation" mode; you also all must so comply or you too will face banishment if a Moderator attempts to initiate a Conversation but finds it blocked.

====> There is NO 'publicity' or any other kind of information leakage that occurs when a "Conversation" mode is set to open. It simply is an unfortunate glitch in the platform TMC uses.<=====

FIRST, LAST & ONLY WARNING

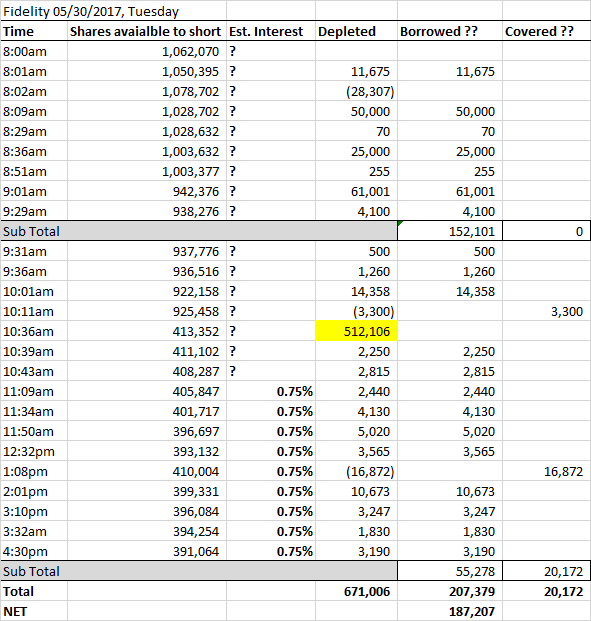

There was an interesting action today at Fidelity as far as shares available for shorting are concerned. The day started with a lot of shares available: since I started to keep records in September of 2016 there were only 6 days with more shares available.

Those making decisions at Fidelity apparently expected high demand for shorting, which, however, did not materialize. Note that 512k reduction in shares available for shorting noted in snap shot of the trading screen at 10:36am, judging by the intraday TSLA chart, was likely not the result of short sellers borrowing, but Fidelity realizing that demand for shorting is low and finding a better use for these shares.

There also likely was not a huge amount of covering, as evident from the screen shots of short selling trading screen in the table below.

All in all, it seems that there was a lot of confusion among the short sellers. They do not seem to feel the heat yet, or just paralyzed by the swift action in the direction opposite to their convention.

I think that if we will indeed see inverse head and shoulder pattern mentioned by @Curt Renz play out with the target around $360, there will be a lot of short sellers seriously hurting. I personally am not in a hurry, let them stay a little longer.

Note: question mark for estimated interest indicates that this info was not available (was not shown on the Fidelity trading screen)

Those making decisions at Fidelity apparently expected high demand for shorting, which, however, did not materialize. Note that 512k reduction in shares available for shorting noted in snap shot of the trading screen at 10:36am, judging by the intraday TSLA chart, was likely not the result of short sellers borrowing, but Fidelity realizing that demand for shorting is low and finding a better use for these shares.

There also likely was not a huge amount of covering, as evident from the screen shots of short selling trading screen in the table below.

All in all, it seems that there was a lot of confusion among the short sellers. They do not seem to feel the heat yet, or just paralyzed by the swift action in the direction opposite to their convention.

I think that if we will indeed see inverse head and shoulder pattern mentioned by @Curt Renz play out with the target around $360, there will be a lot of short sellers seriously hurting. I personally am not in a hurry, let them stay a little longer.

Note: question mark for estimated interest indicates that this info was not available (was not shown on the Fidelity trading screen)

realizing that demand for shorting is low and finding a better use for these shares.

What better use would they have for these shares?

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 881