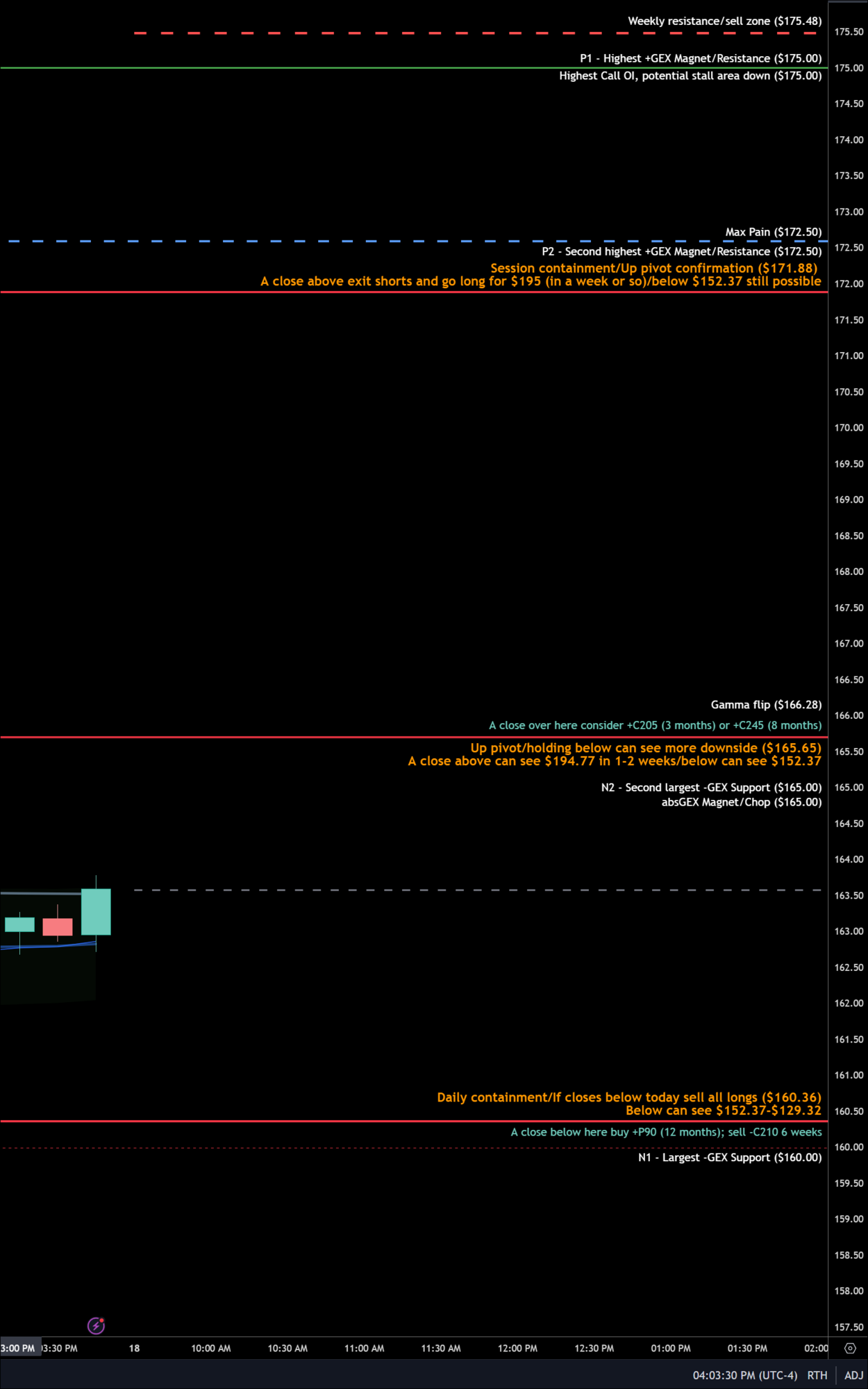

If the SP opens lower tomorrow, and heads down, my decisions are easy. Keep the protective spreads, for this week and next, for nice profits. The tough decision will come if we open higher or go green, because then I will have to decide if I close them while they still have value, and decide if I open new weekly CCs and how aggressive I get (170 strike or higher).

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

On Friday I bought 10 p150 for next week and on Monday I will buy 50 put spreads +p125/-p115 for April 26th, a week after earnings.

Really good stuff, thanks for compiling. Seems we are at an inflection point here at $160 with mixed signals underneath (bullish divergence, etc).

Any reason for choosing +P150 3/22 vs closer to the money? It seems it needs a huge drop to be profitable and it starts dying Tuesday PM through end of week:

Also what’s the reason for going so low on the +P125/-P115 4/26? Seems needs a huge crater too to be profitable:

Last edited:

Any reason for choosing +P150 3/22 vs closer to the money? It seems it needs a huge drop to be profitable and it starts dying Tuesday PM through end of werk.

Also what’s the reason for going so low on the +P125/-P115 4/26? Seems needs a huge crater too to be profitable:

Sorry, it’s 10 x +p160, not +p150. I’ll fix my previous post.

The spread +P125/-p115 was chosen because of the TA target (115) and the relative low price for that longer expiry date, allowing me to buy more of them.

Thanks. With the caveat that I’m no spread expert, wouldn’t closer to the money, even a little bit, make a big difference to be worth it in case we only gap fill ($142) or hit $130 or even do hit $115?Sorry, it’s 10 x +p160, not +p150. I’ll fix my previous post.

The spread +P125/-p115 was chosen because of the TA target (115) and the relative low price for that longer expiry date, allowing me to buy more of them.

Last edited:

tivoboy

Active Member

Their channel lines continue to steepen.. what happens when the parallel lines go vertical? ;-)

Their channel lines continue to steepen.. what happens when the parallel lines go vertical? ;-)

Stay tuned!

Looks reverse NVDA...steep channels don't last very long

Here's TSLA flipped for an interesting perspective:

Last edited:

tivoboy

Active Member

Ok, that’s funny… just glancing I thought the top one was NVDA and the bottom was TSLA but inversed, and they were essentially the exact opposite.. ;-). Would have been WaAAY to coincidental, if not somewhat accurate.Stay tuned!

Looks reverse NVDA...steep channels don't last very long

Here's TSLA flipped for an interesting perspective:

View attachment 1029009

View attachment 1029010

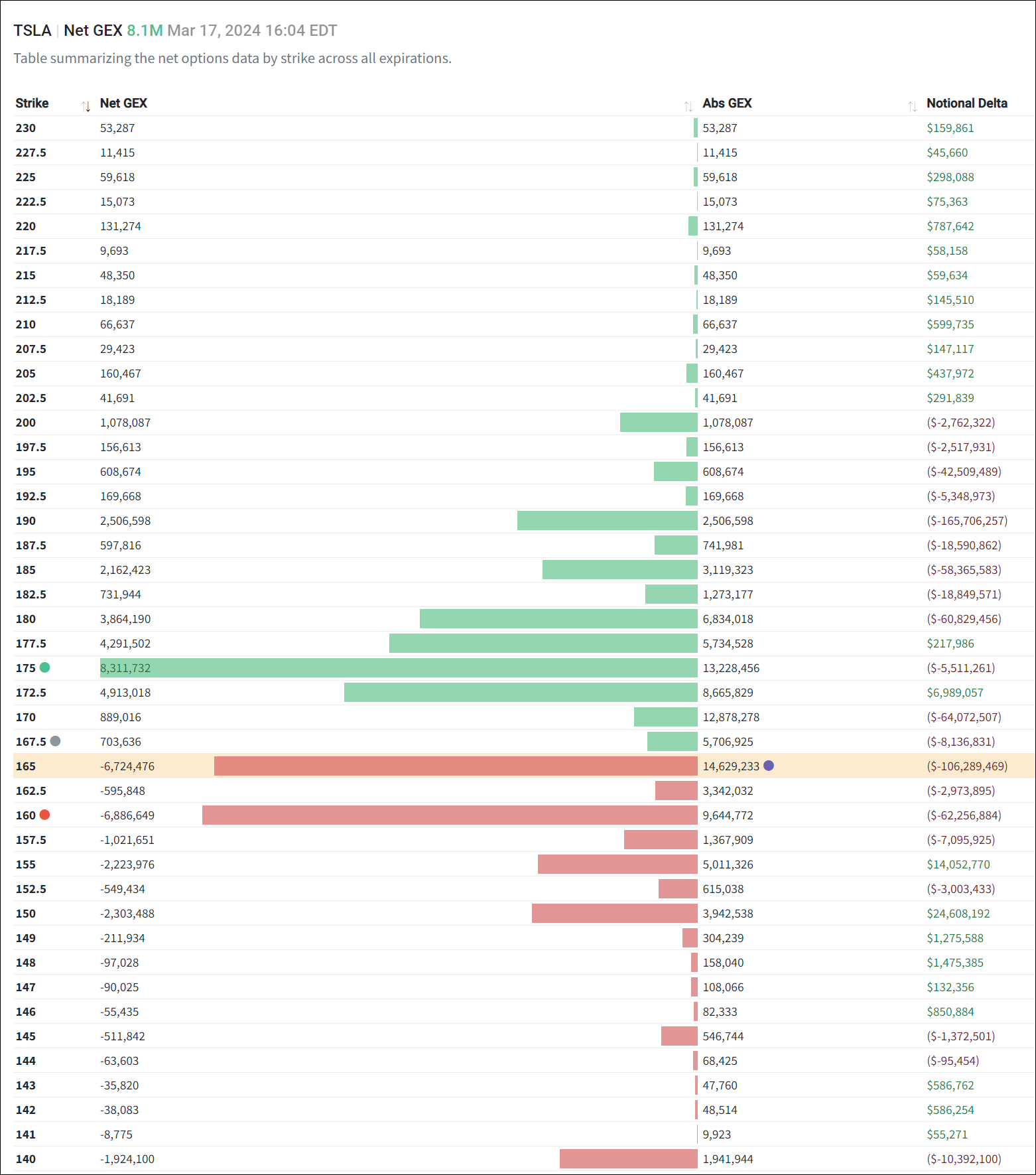

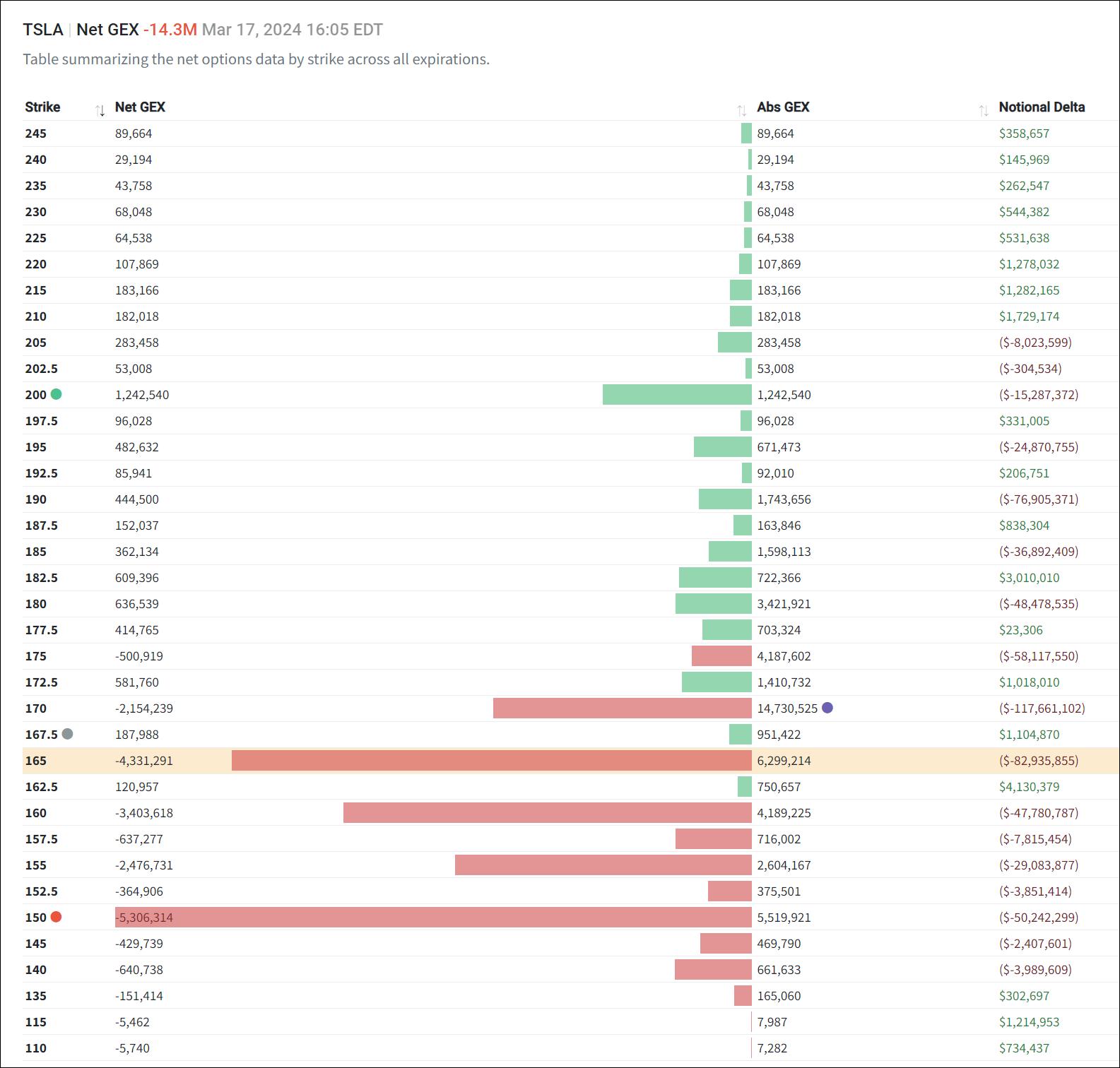

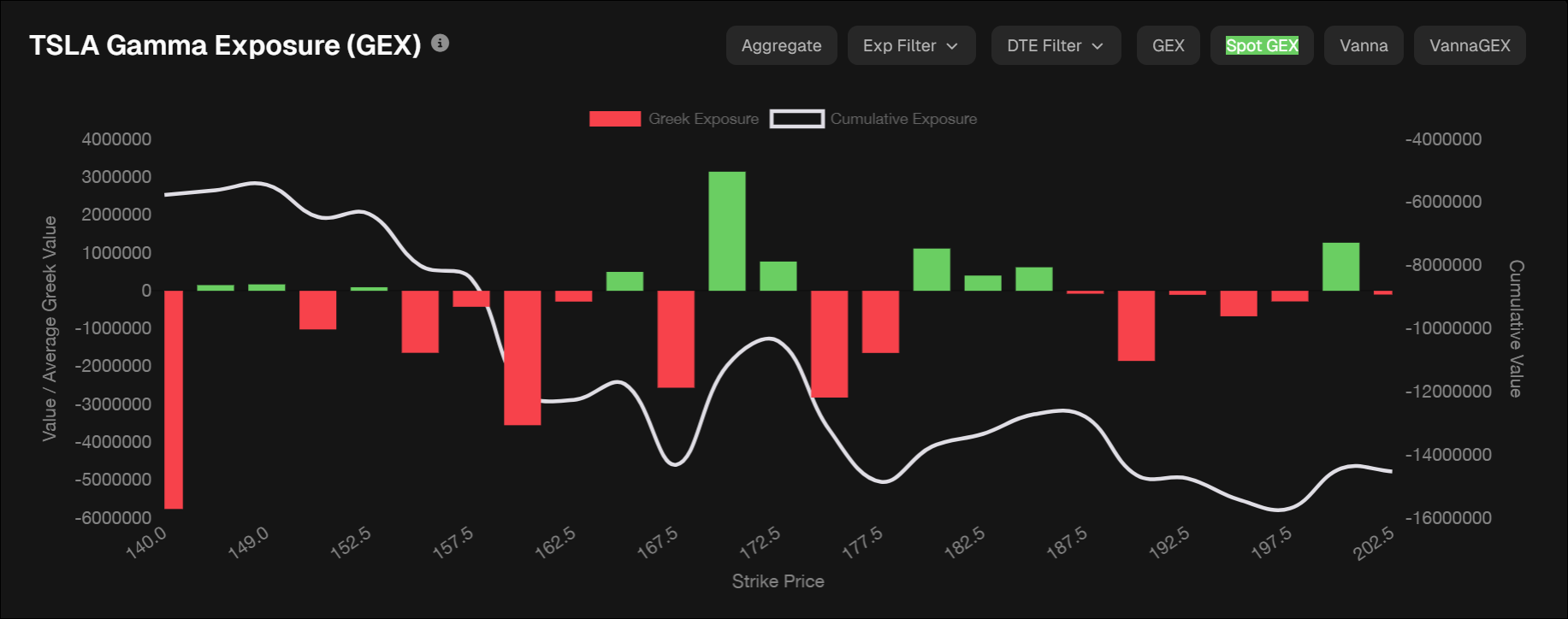

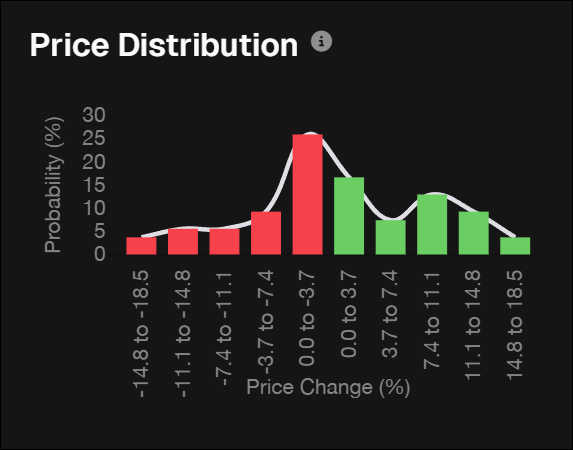

Preview draft for the coming week:

3/22

3/28

This usually indicates chop/volatility, with bullish inclination mid-week:

Dealer Deltas back strong negative delta (generally positive for SP):

3/22

3/28

This usually indicates chop/volatility, with bullish inclination mid-week:

Dealer Deltas back strong negative delta (generally positive for SP):

Ok, that’s funny… just glancing I thought the top one was NVDA and the bottom was TSLA but inversed, and they were essentially the exact opposite.. ;-). Would have been WaAAY to coincidental, if not somewhat accurate.

Now that you mention it, here they are overlayed. See how last week ended for both

ChiefRollo

Member

Wonder how many mistakes an average NY city taxi driver makes a week. What’s the appropriate target for autonomous driving? Is it statistically significantly better than average human driver or it perfect (zero or 1 mistake per X years)?I regularly drive with no interventions on 11. So, if anything 12 has not degraded much

One thing we should all keep in mind is - FSD and robotaxi are not what it does. It is about what it doesn't i.e. see what mistakes FSD does in one month or one year (or ten years). For FSD to be robotaxi level, it needs to make no more than one mistake in 10 years of driving.

ps : But here is the important part - at any point the market might decide Tesla has "solved FSD" for no particular reason. So, we may have a Hertz or NACS moment that adds 30% or more to the SP.

Open question:

So let's say deliveries for Q1-2024 come in around 410k-420k, what metric do we use to guesstimate how it hits the share price, to gauge if it may be already "priced in," by how much, etc.? This can be important in deciding if to cut longs (and short puts) while we can up here ($160's) before we're looking at sub-$140-$130-$120, etc pretty soon. Or is the panic overdone.

So let's say deliveries for Q1-2024 come in around 410k-420k, what metric do we use to guesstimate how it hits the share price, to gauge if it may be already "priced in," by how much, etc.? This can be important in deciding if to cut longs (and short puts) while we can up here ($160's) before we're looking at sub-$140-$130-$120, etc pretty soon. Or is the panic overdone.

Last edited:

tivoboy

Active Member

Technically, for THAT range (210-220K) one would use a scimitar metric blade, cut it in half, right off at the knees. Wait while I look for a decent representation of what that would look like.Open question:

So let's say deliveries for Q1-2024 come in around 210k-220k, what metric do we use to guesstimate how it hits the share price, to gauge if it may be already "priced in," by how much, etc.? This can be important in deciding if to cut longs (and short puts) while we can up here ($160's) before we're looking at sub-$140-$130-$120, etc pretty soon. Or is the panic overdone.

Technically, for THAT range (210-220K) one would use a scimitar metric blade, cut it in half, right off at the knees. Wait while I look for a decent representation of what that would look like.

My mistake! I meant 410k-415k

Fixed in original post.

Question still stands:

What metric do we use to guesstimate how it hits the share price, to gauge if it may be already "priced in," by how much, etc.? This can be important in deciding if to cut longs (and short puts) while we can up here ($160's) before we're looking at sub-$140-$130-$120, etc pretty soon. Or is the panic overdone.

(Focusing on margins instead of volume could be a new path?)

Last edited:

ChiefRollo

Member

I’m asking because I don’t have the information. How well did these analysts do in their ongoing valuations of Amazon back in the day? How well informed were they of say Amazon’s cloud investment…and did they know / were they close on the value and power of cloud? I wonder if there were talks of PE ratio for booksellers the like of Barnes & Noble as a baseline from which that for Amazon was to be considered? If they (the great and powerful analysts) failed and failed miserably then, are they destined to repeat the mistake every time a foreign entity emerges.I got emails from Tesla to configure and order my Foundation series Cybertruck (waiting for the non-Foundation, and then probably another year of manufacturing for early build kinks to get worked out) AS WELL AS a take delivery from inventory by March 31 and we get to port our free supercharging for life plus FSD to the new vehicle.

That second offer actually warranted 5 minutes of conversation, but at 102k miles on our Model X we're content with what we've got. Still the most awesome car that we've owned, and we have an original Tesla Roadster parked in the garage next to it (previously the most awesome car that we've owned; now relegated to #2). The competition is fierce for the title.

My wife probably swaps that order around

I personally don't view these quarter end offers in a hugely negative light. But I do see these as tangible instances in which Tesla is increasingly needing to behaving, and behaving like, traditional car makers. It's a minor piece (adopting behaviors of other auto makers) of a larger thesis I'm still formulating around the idea that Tesla is getting revalued by the market as a whole. If I'm right, that new valuation will be a lot lower than it is today.

My long term / 2030 and beyond hasn't changed, though I should also be evaluating that.

Don’t know about everyone here but I have been using iPhones exclusively for some time. Having invested time, money, and effort in the iOS ecosystem for years now, I cannot fathom the thought of ever testing or trialing or switching to a Xiaomi, Samsung or Motorola phone, regardless of any sexy feature they may come up with; and they have the backing of a solid Android ecosystem (whereas there’s currently no Android equivalence to Tesla for intelligent EVs). That’s not to say Apple’s iOS is great or greater than Google’s Android; I don’t know sh*t about Android…precisely because I haven’t had a compelling enough reason to investigate. Just as buying / owning a smartphone isn’t simply buying / owning a phone as its total ownership experience is a function of the greater ecosystem, the same goes with a Tesla…for me. Although more often than not the three cars in our family were from three different ICE manufacturers back in the day (just as was the case with cell phones before the emergence of the iPhone smartphone), I can’t imagine us having three EV’s from 3 different companies…some from manufacturers that have not spent a dime on its ecosystem. Just as Apple dulled the phone experience…and I’m better for it (or at least okay with not caring about phone unique styles, color, weight and sizes (Nokia at one time had over 100 different phones) and settled on brick (deemed to be the most boring style back in the day before becoming ubiquitous))…and to some extent the watch (Swatch at its peaks had over 1,000 variants of watches), perhaps Tesla will dull the experience of personal automobile…revealing and focusing our interest on the (boring) essentials of cost, safety & simplicity of use and ownership experience…at the expense of unique fanboy desires of engine size, sound & smell, sensation of connectedness to the gear change of the shifter or the windup of the turbo / supercharger, or the brand, history & sense of identity that the family / clan has been clinging to.

Where was I going with this! Yes, I prefer Tesla does and stay Tesla and not conform to the will of analysts…trying to behave as one of the legacy automotive manufacturers. Just as Amazon went about its business and the analysts dragged themselves along the ride, I believe Tesla should stick to its strategy and focus on execution. We’re here because we sense something right about Tesla; as volatility comes with this territory, we can hope to play it to our advantage.

Gary’s (with his 3% TSLA shares) really hammering it today:

FY’24 EPS has dropped to $2.98 (-47% past 12 months), FY’25 to $3.98 (-39%), and FY’28 EPS to $11.82 (-28%). Averaging these, one can say TSLA has lost -38% of its earnings power over the past 12 months. Long-term earnings drive valuation and stock prices.

TSLA FY’24 P/E is now 55x ($164/$2.98 = 55x). TSLA FY’25 P/E is now 41x ($164/$3.98 = 41x). Both are highest among Mag 7 stocks.

TSLA WS 5-year forward volume and eps growth rates are now +18% CAGR and +29% CAGR respectively. TSLA 2024 PEG is now 55x/29% = 1.9x PEG, so avg for the Mag 7 (AAPL 2.6x PEG, NVDA 1.5x PEG, GOOGL 1.3x PEG).

FY’24 EPS has dropped to $2.98 (-47% past 12 months), FY’25 to $3.98 (-39%), and FY’28 EPS to $11.82 (-28%). Averaging these, one can say TSLA has lost -38% of its earnings power over the past 12 months. Long-term earnings drive valuation and stock prices.

TSLA FY’24 P/E is now 55x ($164/$2.98 = 55x). TSLA FY’25 P/E is now 41x ($164/$3.98 = 41x). Both are highest among Mag 7 stocks.

TSLA WS 5-year forward volume and eps growth rates are now +18% CAGR and +29% CAGR respectively. TSLA 2024 PEG is now 55x/29% = 1.9x PEG, so avg for the Mag 7 (AAPL 2.6x PEG, NVDA 1.5x PEG, GOOGL 1.3x PEG).

tivoboy

Active Member

Frankly, I don’t really think there IS a good “metric” for when growth goes NEGATIVE or reverses really unexpectedly..at some point then, it’s going to be derivative impacts like earnings, then margin pressure, then balance sheet, then debt or equity risks, etc. Negative GROWTH can be talked down and around, but one has to be able to put on the RETURN to growth narrative in a believable and achievable way. Sadly, for Tesla and for the BEV industry at this point ppl have started to believe that “winter is coming” and a period of either flat to negative growth is expected.My mistake! I meant 410k-415k

Fixed in original post.

Question still stands:

What metric do we use to guesstimate how it hits the share price, to gauge if it may be already "priced in," by how much, etc.? This can be important in deciding if to cut longs (and short puts) while we can up here ($160's) before we're looking at sub-$140-$130-$120, etc pretty soon. Or is the panic overdone.

Personally, I do NOT think that Wall Street, or all the analysts or even large holders or retail have YET priced in what a true NEGATIVE P&D might represent for market sentiment. So no, I don’t think it’s all yet priced in.

It’s NOT going to be a traditional OEM automotive metric. Even an elevated one, say 10-12 P/E..it’s also not going to be an overall high margin, overall software or tech company metric. Although, many of those, producing high growth, high margin, high returns are ~ 40x.

At least for 2024, and some large portion of 2025, assuming a return to hopefully, OVER $4 a share in E, and a 35-40x P/E. On say $5 a share in 2025, one should be able to justify 175-200 a share, but not today.

Energy or batteries have to MOON and for whatever reason that just doesn’t seem to be happening yet.

Rob Maurer video in Chicago. I grew up there. Driving is a nightmare. FSD handled heavy car and pedestrian traffic like a champ. Check out the 5 min mark. Parks at destination at 13:30. Just WOW.

Then check out this amazing move.

Then check out this amazing move.

Last edited:

tivoboy

Active Member

Sadly, this has not been my experience with 12.3 at all. With my car, those ppl would have been dead and all wheels would need replacing. It’s just sad. If ANYTHING the variability is unacceptable. IF there COULD be CAR TO CAR variances, that is a failure in engineering, sensor calibration or device calibration-which should not be acceptable. I’m annoyed.Rob Maurer video in Chicago. I grew up there. Driving is a nightmare. FSD handled heavy car and pedestrian traffic like a champ. Check out the 5 min mark. Parks at destination at 13:30. Just WOW.

Then check out this amazing move.

Would you accept trim controls that seemed to be markedly different between various C10X versions? A six here, was actually a 4 THERE, or just a tick or two was required to settle vs. FOUR ticks in same circumstance or situation on another aircraft of the same model and configuration?

Interesting that your experience is different. But replacing 300,000+ lines of code with Neural Net training means progress is going to be very fast now. My understanding is that they are teaching a computer brain to drive just like a human brain would learn.Sadly, this has not been my experience with 12.3 at all. With my car, those ppl would have been dead and all wheels would need replacing. It’s just sad. If ANYTHING the variability is unacceptable. IF there COULD be CAR TO CAR variances, that is a failure in engineering, sensor calibration or device calibration-which should not be acceptable. I’m annoyed.

Would you accept trim controls that seemed to be markedly different between various C10X versions? A six here, was actually a 4 THERE, or just a tick or two was required to settle vs. FOUR ticks in same circumstance or situation on another aircraft of the same model and configuration?

I'm closing my protective spreads tomorrow morning if we open green. We had a major sell off so far this year on slower auto growth. The growth of Tesla AI and FSD is about to happen. I'm strapping in for 2019 V2!

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 6K