During "Alpha Release" :redface: of the Tesla Leasing and Tesla Lending "Apply online" links on Friday, I called Tesla Finance to inquire about the leasing money factor and residuals, and the top-tier financing rates for various terms. They appear to be the same/similar to Model S. Here they are. Note this was as of 10/23/2015. I repeated them back for confirmation and told the rep I'm going to share it on TMC. However, I take no responsibility for accuracy and you should definitely call Tesla Finance yourself at 1-650-681-6789 for confirmation when you configure your X.

The minimum down payment is 10%, and of course the $5K reservation is applied towards that.

Tesla Leasing

36 month lease with a 0.0016 Money Factor (MF) * 2,400 = 3.8%

Residual Values:

60% for 10K miles/year

59% for 12K miles/year

58% for 15K miles/year

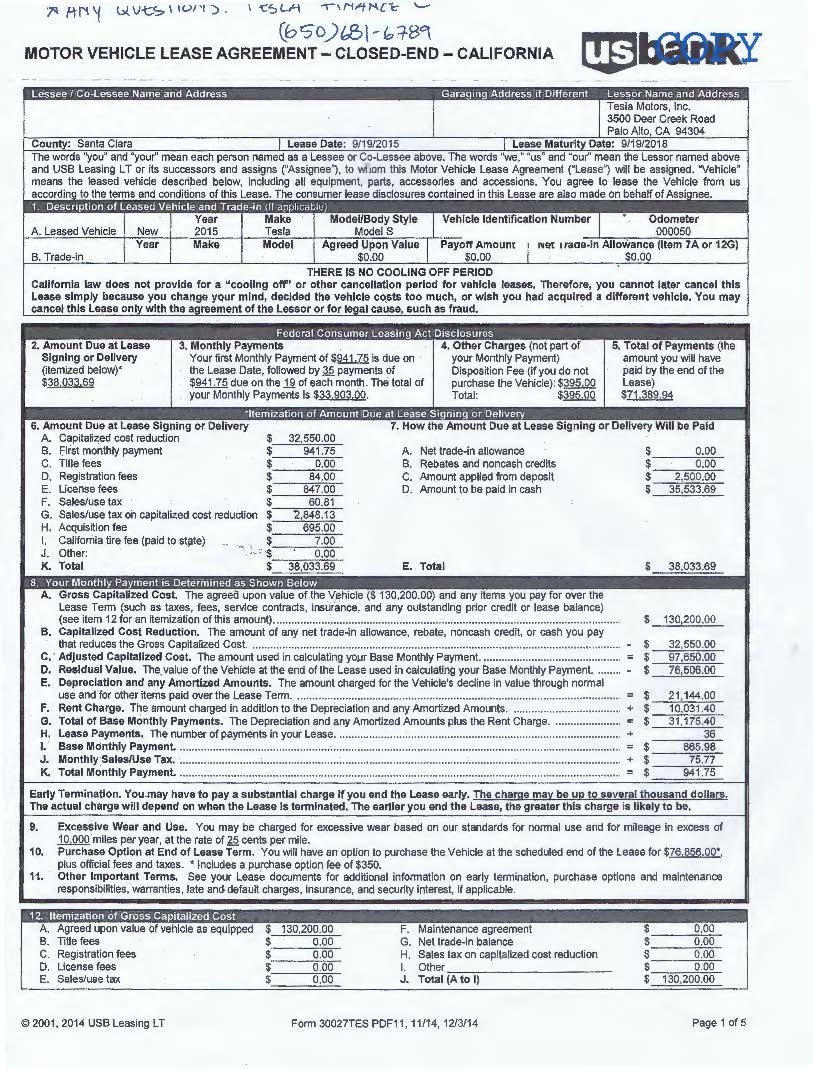

The rep. said the X lease agreement will look just like the one used for the S. See at the end of this post for a sample Model S Motor Vehicle Lease Agreement - Closed-End - California.

Tesla Financing

I just asked about the financing rates for top-tier credit since I know I have 850 FICO. (I forgot to ask the minimum score for top-tier.) The rep. said the best rate for top-tier through them would be a loan funded by U.S. Bank at these rates:

36 months: 1.95%

48 months: 2.05%

60 months: 2.15%

72 months: 2.65%

The other financial institutions Tesla Finance LLC works with are: Wells Fargo, JPMorgan Chase, and TD (Ameritrade) Auto Finance.

I asked whether there is a Guaranteed Buyback Program offered for Model X. They said yes, and it works like this:

The customer can return your financed or owned vehicle to Tesla anytime between months 36 and 39. The customer will receive 50% of the original base price, and 42% of all the original cost of options (they depreciate more) on their vehicle. From my recollection, this works the same way as Model S?

I recall there are lower financing rates available from 3rd parties, but then you forgo the X Guaranteed Buyback Program. Based on the lease residual range of 58-60%, however, IMHO our X'es will most likely be worth more then a blended value of 50%/42% at the end of 36 months - so it's probably a moot point.

If anyone hears anything different or notices a typo, please post it. If it's confirmed by a second Tesla Finance rep, then I'll update these figures.

The minimum down payment is 10%, and of course the $5K reservation is applied towards that.

Tesla Leasing

36 month lease with a 0.0016 Money Factor (MF) * 2,400 = 3.8%

Residual Values:

60% for 10K miles/year

59% for 12K miles/year

58% for 15K miles/year

The rep. said the X lease agreement will look just like the one used for the S. See at the end of this post for a sample Model S Motor Vehicle Lease Agreement - Closed-End - California.

Tesla Financing

I just asked about the financing rates for top-tier credit since I know I have 850 FICO. (I forgot to ask the minimum score for top-tier.) The rep. said the best rate for top-tier through them would be a loan funded by U.S. Bank at these rates:

36 months: 1.95%

48 months: 2.05%

60 months: 2.15%

72 months: 2.65%

The other financial institutions Tesla Finance LLC works with are: Wells Fargo, JPMorgan Chase, and TD (Ameritrade) Auto Finance.

I asked whether there is a Guaranteed Buyback Program offered for Model X. They said yes, and it works like this:

The customer can return your financed or owned vehicle to Tesla anytime between months 36 and 39. The customer will receive 50% of the original base price, and 42% of all the original cost of options (they depreciate more) on their vehicle. From my recollection, this works the same way as Model S?

I recall there are lower financing rates available from 3rd parties, but then you forgo the X Guaranteed Buyback Program. Based on the lease residual range of 58-60%, however, IMHO our X'es will most likely be worth more then a blended value of 50%/42% at the end of 36 months - so it's probably a moot point.

If anyone hears anything different or notices a typo, please post it. If it's confirmed by a second Tesla Finance rep, then I'll update these figures.