Since I have a very early P83 production reservation, I spent 2.5 hours at the Fremont Factory Store on Saturday morning, 9/19/2015, to learn as much as I could about Model X in order to prepare myself to configure and lease it for my business. This post covers what I learned about Model X business leasing in California. I have considerable experience leasing various Mercedes business vehicles, so I'm very familiar with converting a money factor to an interest rate, and how residual values work, etc. Fortunately, when dealing with Tesla Sales, I won't have to haggle over the gross capitalized cost of my vehicle anymore, which will be a great time-saver. (Instead, I've spent 3 years and 7 months reading this forum :biggrin:.)

Basically, Model X leasing will work "pretty much the same way as it does for Model S today". I spoke with the most senior product specialist available. He called Tesla Finance. They said that leasing will not be available until production. In fact, their own internal software doesn't even show "Model X" yet since the code hasn't been released to them. Someone that has configured and ordered their Signature can confirm whether or not Leasing was an option offered to you?

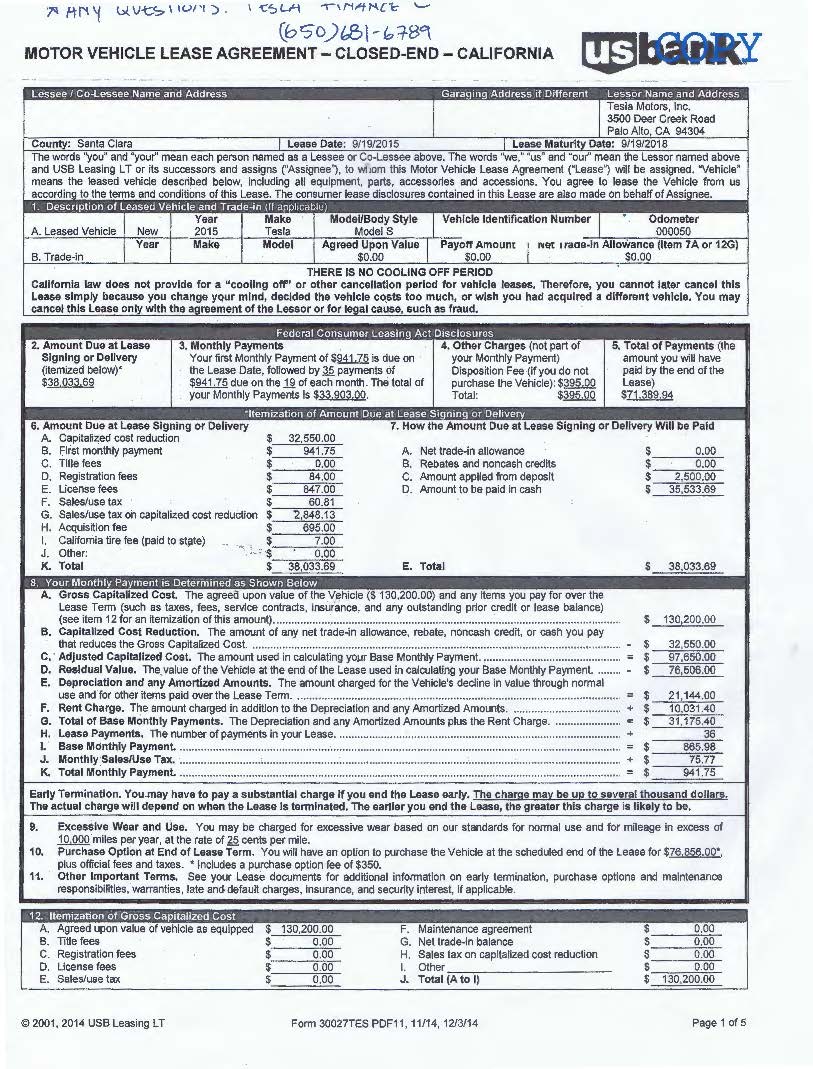

I was told that the majority of leases are done through US Bank, so they don't have to tie-up TSLA's money. I requested a sample copy of the lease agreement for Model S, which is attached below. They just whited-out the buyer and VIN. I didn't get a copy of the 4 pages of fine print. If anyone would like to read it, I can get that, too.

Like Model S, all leases will be for 36 months, with the customer having to choose between 10K, 12K and 15K miles per year. Any mileage driven above this times 3 years will be charged when the vehicle is returned at the rate of $0.25/mile, the same as Mercedes.

I was told the $7,500 Federal tax credit is claimed by US Bank as the owner, and they appear to be using it to raise the residual value, otherwise it wouldn't be so high. This lowers the depreciation cost and hence the monthly lease payment by approx. $208/mo. The $2,500 California rebate is taken by the lessee.

Since agreed upon value of vehicle as equipped on line 12.A is $130,200; it looks like the sample Model S lease customer purchased a P90DL with 10,000 miles per year on line 9.

If anyone would like more information, please call Tesla Finance directly at 1-650-681-6789. On Monday, I'm going to call them to get the money factor and residual value percentage formula they are using for Model S, confirm they are indeed increasing the residual value by $7,500 on S leases, and ask them to call or email me as soon as they have details on Model X production business leasing so I can submit my application.

Russ

Basically, Model X leasing will work "pretty much the same way as it does for Model S today". I spoke with the most senior product specialist available. He called Tesla Finance. They said that leasing will not be available until production. In fact, their own internal software doesn't even show "Model X" yet since the code hasn't been released to them. Someone that has configured and ordered their Signature can confirm whether or not Leasing was an option offered to you?

I was told that the majority of leases are done through US Bank, so they don't have to tie-up TSLA's money. I requested a sample copy of the lease agreement for Model S, which is attached below. They just whited-out the buyer and VIN. I didn't get a copy of the 4 pages of fine print. If anyone would like to read it, I can get that, too.

Like Model S, all leases will be for 36 months, with the customer having to choose between 10K, 12K and 15K miles per year. Any mileage driven above this times 3 years will be charged when the vehicle is returned at the rate of $0.25/mile, the same as Mercedes.

I was told the $7,500 Federal tax credit is claimed by US Bank as the owner, and they appear to be using it to raise the residual value, otherwise it wouldn't be so high. This lowers the depreciation cost and hence the monthly lease payment by approx. $208/mo. The $2,500 California rebate is taken by the lessee.

Since agreed upon value of vehicle as equipped on line 12.A is $130,200; it looks like the sample Model S lease customer purchased a P90DL with 10,000 miles per year on line 9.

If anyone would like more information, please call Tesla Finance directly at 1-650-681-6789. On Monday, I'm going to call them to get the money factor and residual value percentage formula they are using for Model S, confirm they are indeed increasing the residual value by $7,500 on S leases, and ask them to call or email me as soon as they have details on Model X production business leasing so I can submit my application.

Russ

Last edited: