Here are a few tips for Auto Leasing which I have used:

1) Independent Auto Leasing Firms / credit unions, often are more competitive with their APR or Money Factor Rates.

2) Up Front Money - not a good idea if used to lower your monthly lease payment - Up Front Money is typically NOT refunded in insurance claims (Accident Total or Theft or Fire)

3) GAP Insurance is a must - this covers you for the difference in the negotiated end of lease residual value and the actual end of lease value of the auto

4) know your end of lease excess mileage rate, typically 15 to 25 cents per mile over the agreed upon mileage of the lease, you need to build your lease to cover your expected annual mileage X the number of lease years. You do not want to go under or over by many miles.

5) obtain and read the end of lease condition guidelines for a clear understanding of normal wear and tear... this is pretty important as some leasing firms nit pick everything

6) never lease for a time period that is greater than the auto's warranty period. Typical leasing periods are 12, 24, 36 and 48 months. Understand the mileage limits with the time period you are choosing for the lease.

7) negotiate purchase price first.... in the case of Tesla that is not really a factor other than perhaps CPO?

8) negotiate end of lease purchase price or have it divulged (at the end of this lease If I want to but the car what will I pay?) this is a residual value after the lease is up.

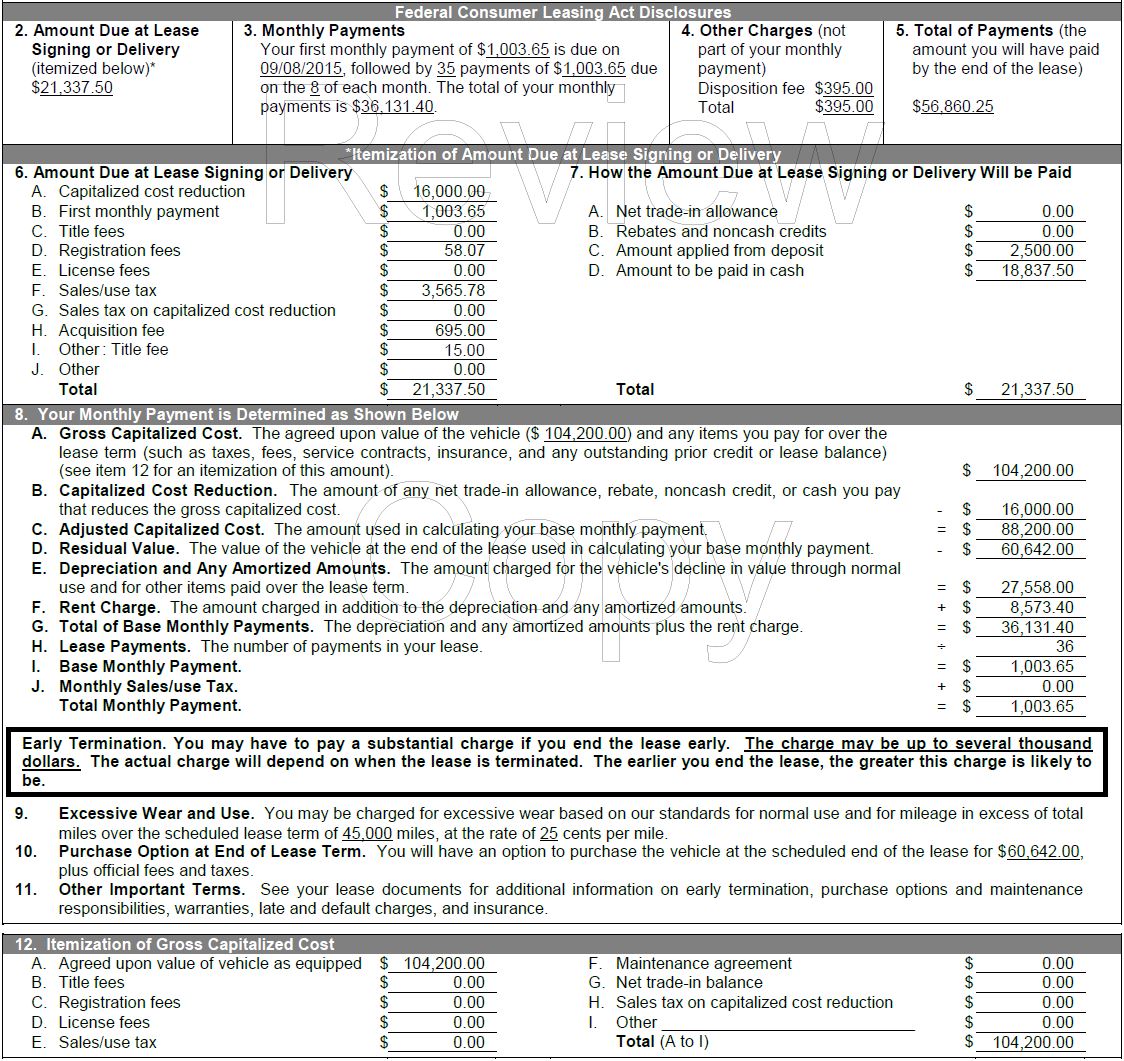

9) leases are not free, the key items are total amount being leased, years, residual value and APR or Money Factor. In addition there often are one time fees up front fees such as

registration, sales taxes, lease acquisition fees, GAP insurance fee.

10) Know the current new car auto loan APR annual percentage rate... you can go to

http://www.bankrate.com to find this out. Let us say this is 4.2% APR. So you can convert this to a Money Factor by dividing the rate by 2400, in this example 4.2 / 2400 = .00175 Now compare this .00175 to the money factor your potential leaser has given you to see if you are getting a good rate. Lower is better, higher is not as good.

APR / 2400 = Money Factor

or

Money Factor X 2400 = APR

11) If believe that if you lease a Tesla, you cannot claim the $7,500 Federal Tax Credit for EV's in the year you lease the car, instead, that credit is owned by the leasing company so double check this fact.

12) If you live in a state or district/city that charges an annual property tax (sometimes called a registration fee in some states/cities) on automobiles, then that annual cost will be yours to pay, the leasing company does not typically pay this annual property tax.

13) Your FICO credit score may have a large effect on the APR / Money Factor you are given. Know your FICO score and if it is high 800 or better then use this to your advantage when dealing with the APR / Money Factor aspect that the lessor provides.