After giving it some thought, this issues deserves a thread for itself, even though it is tied to BEV competition, which has a thread.

If you want to know which OEM's will have a meaningful (say, several 100k EV sales) in the next 5 years you need to talk about battery capacity.

So, who is currently building capacity?

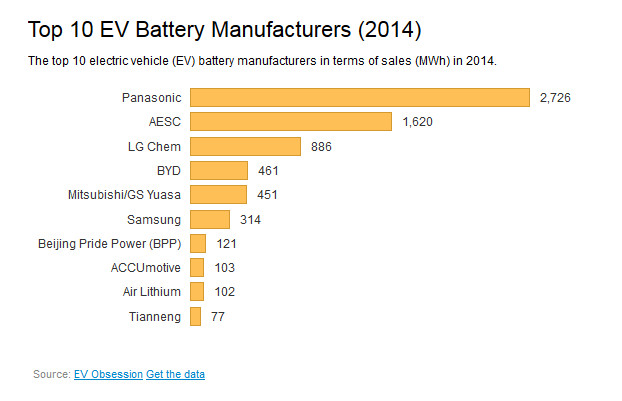

Lets look at the situation at the moment (2014):

(link: Top EV Battery Manufacturers -- 2014 Top 10 In Sales)

We know about the Panasonic/Tesla 35GWh by 2020 gigafactory,

There is also a 34GWh production capacity in several sites by BYD, again by 2020.

(Source: http://www.reuters.com/article/2015/03/13/byd-battery-idUSL1N0WE37P20150313)

One source claims Nissan might be planning to look outside AESC for batteries, and might turn to LG Chem:

Nissan's Electric-Car Battery Future: Will It Be With LG Chem?

Which brings up the question, what is the planned expansion for LG Chem?

Here is one plant:

Koreas LG Chem Constructing Chinese EV Battery Plant

"Once completed, the Nanjing battery plant will possess an annual production capacity of over 100,000 EV battery units a year."

This is clearly intended for the Chinese EV market.

From other sources, LG Chem currently has two existing battery plants. One in US, another in Korea.

So beyond the Chinese plant, will they also upgrade the existing plants?

This article claims they were at least at one point thinking about it:

http://www.reuters.com/article/2014/05/29/lg-chem-factory-idUSL3N0OF19Q20140529

"Car battery maker LG Chem to decide on capacity expansion in 3 months"

I couldn't find the follow up though.

As for what kind of capacity would they want, here is an interview Prabhakar Patil, CEO of LG Chem:

Battery maker shrugs off Tesla competition

Relevant takeaways:

1. They expect to have a 25% - 30% market share of capacity going forward (of what expected capacity??).

2. Mr. Patil has some doubts for the 500k per year capacity Tesla expects.

3. LG Chem's Holland, Mich., plant is working at 25 to 30 %of capacity, it needs to be at 80% to be profitable.

OK, so they probably won't be expanding it any time soon...

Altogether I don't see a plan for significant capacity expansion, excluding the new Chinese plant.

If there will be new suppliers, say, in China, that might be expanding capacity besides BYD, it would be an interesting story, but they would be starting from a low base point as the above graph shows.

In conclusion:

1. The big stories seem to be Panasonic/Tesla, BYD, and any future plans for expansion by LG Chem.

2. Currently there is one visible expansion plan for LG Chem, that is a new battery plant in China, for China.

3. There could be new other battery suppliers but they will be starting from a relatively low base point.

In any case, this is worth following since the future of EVs is tied completely into battery capacity. In other words, no batteries - no EVs.

If you want to know which OEM's will have a meaningful (say, several 100k EV sales) in the next 5 years you need to talk about battery capacity.

So, who is currently building capacity?

Lets look at the situation at the moment (2014):

(link: Top EV Battery Manufacturers -- 2014 Top 10 In Sales)

We know about the Panasonic/Tesla 35GWh by 2020 gigafactory,

There is also a 34GWh production capacity in several sites by BYD, again by 2020.

(Source: http://www.reuters.com/article/2015/03/13/byd-battery-idUSL1N0WE37P20150313)

One source claims Nissan might be planning to look outside AESC for batteries, and might turn to LG Chem:

Nissan's Electric-Car Battery Future: Will It Be With LG Chem?

Which brings up the question, what is the planned expansion for LG Chem?

Here is one plant:

Koreas LG Chem Constructing Chinese EV Battery Plant

"Once completed, the Nanjing battery plant will possess an annual production capacity of over 100,000 EV battery units a year."

This is clearly intended for the Chinese EV market.

From other sources, LG Chem currently has two existing battery plants. One in US, another in Korea.

So beyond the Chinese plant, will they also upgrade the existing plants?

This article claims they were at least at one point thinking about it:

http://www.reuters.com/article/2014/05/29/lg-chem-factory-idUSL3N0OF19Q20140529

"Car battery maker LG Chem to decide on capacity expansion in 3 months"

I couldn't find the follow up though.

As for what kind of capacity would they want, here is an interview Prabhakar Patil, CEO of LG Chem:

Battery maker shrugs off Tesla competition

Relevant takeaways:

1. They expect to have a 25% - 30% market share of capacity going forward (of what expected capacity??).

2. Mr. Patil has some doubts for the 500k per year capacity Tesla expects.

3. LG Chem's Holland, Mich., plant is working at 25 to 30 %of capacity, it needs to be at 80% to be profitable.

OK, so they probably won't be expanding it any time soon...

Altogether I don't see a plan for significant capacity expansion, excluding the new Chinese plant.

If there will be new suppliers, say, in China, that might be expanding capacity besides BYD, it would be an interesting story, but they would be starting from a low base point as the above graph shows.

In conclusion:

1. The big stories seem to be Panasonic/Tesla, BYD, and any future plans for expansion by LG Chem.

2. Currently there is one visible expansion plan for LG Chem, that is a new battery plant in China, for China.

3. There could be new other battery suppliers but they will be starting from a relatively low base point.

In any case, this is worth following since the future of EVs is tied completely into battery capacity. In other words, no batteries - no EVs.