Has anyone noticed this year a rather large price increase for their Roadster? I'm curious to see if Roadsters, or the Tesla name, have become more well known causing the insurance rates to increase.

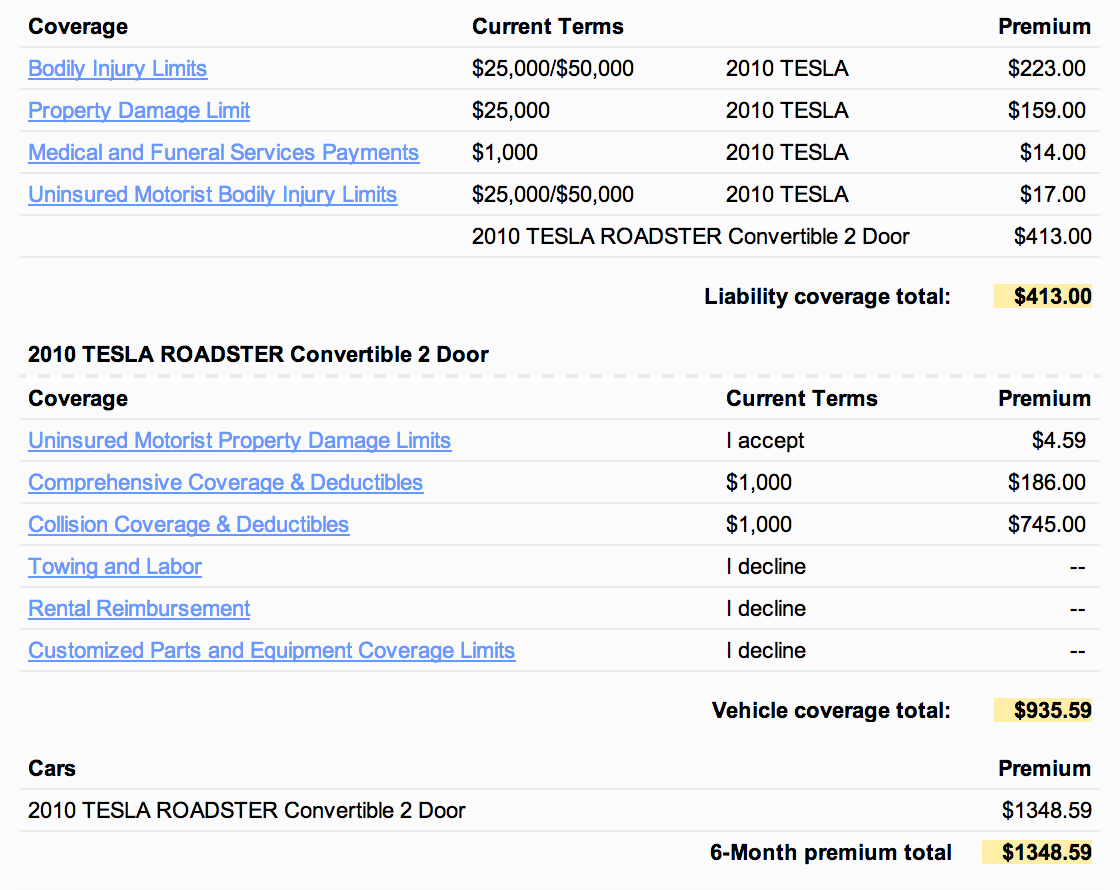

This screenshot shows last years rate, and the below quote shows what it is going up to. No explanation given on the website, i'll call in to find out more. Only other thing I can think of was the accident I had this year, but I can't imagine nearly doubling the rate.

This screenshot shows last years rate, and the below quote shows what it is going up to. No explanation given on the website, i'll call in to find out more. Only other thing I can think of was the accident I had this year, but I can't imagine nearly doubling the rate.

Effective date of new policy term: 07/20/2013 Last 6-month premium: $1,348.59 New 6-month premium: $2,656.89