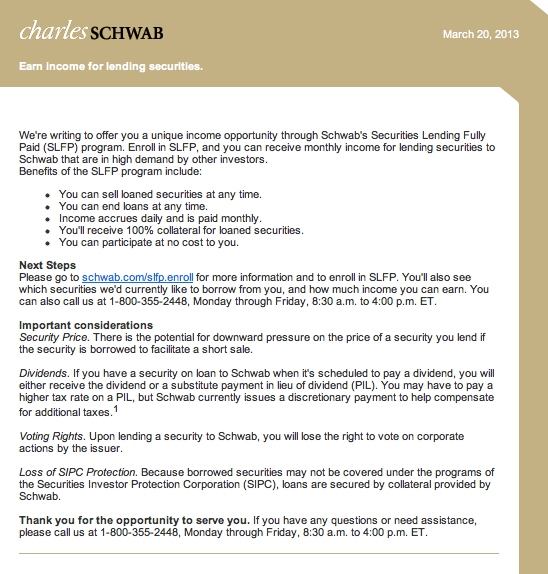

I received this curious offer from my broker... Would I be willing to loan some of my stock to another Schwab investor? I've received a couple of these offers since I began buying TSLA last fall. I think it's highly probable that this offer is related to my TSLA shares. Is it just me, or would I be a tad disingenuous in loaning my Tesla shares to someone else so they can short the stock? Why would anyone who has a long term horizon and believes in the company be willing to do this??

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Willing to let someone borrow your Tesla shares?

- Thread starter ToddRLockwood

- Start date

-

- Tags

- Tesla Inc.

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

With the TSLA short interest that seems to never fall no wonder people are lining up to borrow your shares (to short sell of course). As long as the fine print confirms the bullet points in the mail there seems to be virtually no risk to you, you can end the loan when you want and sell your shares. I'd say go for it! You will be earning a little while doing it plus you will contribute to keeping up the short interest, which in turn will benefit us long investors in the long run.

carrerascott

FUEL FTR

If you do not allow Schwab to let another customer borrow your shares, then Schwab will have to buy the shares in the open market and lend them to to the other customer. Of course that other customer will immediately sell the shares short. In this case there should be no net effect on the share price once both trades are complete. However, if you agree to Schwab's proposal, then the inevitable short sale could add to downward pressure on the share price with no previous purchase by Schwab to compensate.

It's true that any future short covering should raise the share price. But that would be from a lower level than otherwise, if you and other brokerage customers previously allowed their shares to be borrowed and then sold short.

My recommendation: Ignore the offer and force Schwab to buy the shares that they want to lend to another customer for shorting.

It's true that any future short covering should raise the share price. But that would be from a lower level than otherwise, if you and other brokerage customers previously allowed their shares to be borrowed and then sold short.

My recommendation: Ignore the offer and force Schwab to buy the shares that they want to lend to another customer for shorting.

Last edited:

Zzzz...

Member

If you do not allow Schwab to let another customer borrow your shares, then Schwab will have to buy the shares in the open market and lend them to to the other customer. Of course that other customer will immediately sell the shares short. In this case there should be no net effect on the share price once both trades are complete. However, if you agree to Schwab's proposal, then the inevitable short sale could add to downward pressure on the share price with no previous purchase by Schwab to compensate.

True. But if someone holding TSLA as a long term investment, letting shares to be short sold now wont affect long term price, because if Tesla will be successful, shorts will go away and would have to cover anyway. Plus such action will help those who still investing into TSLA to jump in at lower price point.

If Tesla will go down, you will at least make some money.

But sure letting shorts to borrow your shares is damaging to Tesla. Tesla will have to use more shares in a near term for stock based compensations. And if Tesla will need to raise more capital in near future, TM will do it on less favorable terms. Diluting positions of current shareholders.

Anyhow, money is a money, and if you not need shares for any other purposes (you are not trying to time the market, position is not part of margin account), then why not? And unless we are talking about hundred thousands shares or more, your decision wont affect share price in any significant way. May be if hundreds small shareholders will fall for a Schwab's offer than we would be talking... About 0.1% price drop. But implication for your wallet - you can directly calculate how much would you make, and is it worth bothering provided size of your position and your financial situation.

On a side note, Schwab would not neseserely would have to buy TSLA shares, they might increase payouts to potential lenders of shares in attempt to get more shareholders to loan.

Keep in mind that short sellers can greatly leverage their downward pressure on share price by pushing it through the stop limits set by current shareholders. Even those without set limits can be panicked. While this may appear to only have short term effect, it lowers the base from which long term advances must ascend.

Zzzz...

Member

Keep in mind that short sellers can greatly leverage their downward pressure on share price by pushing it through the stop limits set by current shareholders. Even those without set limits can be panicked. While this may appear to only have short term effect, it lowers the base from which long term advances must ascend.

Interesting! I was not thinking about this effect...

- - - Updated - - -

But you remember that biggest TSLA drop when chief designer left and market panicked, or at least looked like it from a huge drop... TSLA recovered back to normal in a matter of days and managed to hit all time high two and a half months later...

If you do not allow Schwab to let another customer borrow your shares, then Schwab will have to buy the shares in the open market and lend them to to the other customer. Of course that other customer will immediately sell the shares short. In this case there should be no net effect on the share price once both trades are complete. However, if you agree to Schwab's proposal, then the inevitable short sale could add to downward pressure on the share price with no previous purchase by Schwab to compensate.

It's true that any future short covering should raise the share price. But that would be from a lower level than otherwise, if you and other brokerage customers previously allowed their shares to be borrowed and then sold short.

My recommendation: Ignore the offer and force Schwab to buy the shares that they want to lend to another customer for shorting.

Curt, thanks for your wisdom and insight. Clearly, what is good for Tesla is good for it's shareholders.

Personally I would never - my TSLA is mine to keep

agree about Curts point of view, if you loan out your share it will eventually influence long time share price due to lesser buy/sell demant

I asume there is also a potential lost of shares if schwab goes bankrupt - not shure about this though.

agree about Curts point of view, if you loan out your share it will eventually influence long time share price due to lesser buy/sell demant

I asume there is also a potential lost of shares if schwab goes bankrupt - not shure about this though.

RFBrost

Member

I participate in Schwab’s SFLP program and loan them my TSLA shares. They pay you a good interest rate which varies by market demand but has been between 2-4%. They also send you a letter of credit from an unaffiliated financial institution which cover’s the full value of your holdings if Schwab were to fail to meet their obligations under the loan agreement. They can borrow shares from either a taxable account or an IRA. I let them borrow shares from both my accounts. The mechanics of the loan are well thought out. They open a second “loan” account for each type of borrowing. In my case one “loan” account is tied to my taxable account and one “loan” account is tied to my Roth IRA. When they borrow the shares they transfer them to the loan account. This is useful because you can display the loan account to get your TSLA quotes or you can set up eMail notifications etc just like with your regular account. If you need to sell your shares, there is no delay, you can issue a sell order against the loan account and it is executed. Every month, the loan account gets the interest payment credited to it and they automatically journal the interest back to your borrowed-from account. It is as-if TSLA paid a dividend except it occurs monthly rather then quarterly. I think it is great. When I buy more stock, I eMail the SFLP department to alert them of the additional shares and they usually borrow them as well. When the amount of shares changes or every quarter they FedEx you an updated letter of credit to keep the collateral current. Its free money!

As to your consideration regarding “supporting” TSLA vs. the shorters, I love the idea that I am going to get a big payday while they are going to suffer financially for their cynicism and lack of faith in Elon Musk. I don’t see any harm allowing these shorting fools to loose their money. If they couldn’t short TSLA they would try to short SCTY or AAPL. Any great company that pushes us toward a better future is a perceived threat to those that are deeply invested in the status quo. And as a practical matter, if you don’t loan your shares, Schwab will probably find someone else (like me) to loan them the shares so you really don’t have an opportunity to stop the shorts from doing their thing, and besides, why not profit from their foolishness?

As to your consideration regarding “supporting” TSLA vs. the shorters, I love the idea that I am going to get a big payday while they are going to suffer financially for their cynicism and lack of faith in Elon Musk. I don’t see any harm allowing these shorting fools to loose their money. If they couldn’t short TSLA they would try to short SCTY or AAPL. Any great company that pushes us toward a better future is a perceived threat to those that are deeply invested in the status quo. And as a practical matter, if you don’t loan your shares, Schwab will probably find someone else (like me) to loan them the shares so you really don’t have an opportunity to stop the shorts from doing their thing, and besides, why not profit from their foolishness?

cwerdna

Well-Known Member

IB has something similar. See http://ibkb.interactivebrokers.com/node/1838.

Unfortunately (?), I've closed my account w/IB for various reasons, partly it's due to their monthly minimums (in terms of commissions you need to generate each month, or else you have to pay the difference) and them not offering certain featured I like that TD AM/TOS has (e.g. buying back short option positions for a nickel or less for no commission).

Unfortunately (?), I've closed my account w/IB for various reasons, partly it's due to their monthly minimums (in terms of commissions you need to generate each month, or else you have to pay the difference) and them not offering certain featured I like that TD AM/TOS has (e.g. buying back short option positions for a nickel or less for no commission).

reddy

Active Member

Surprised I didn't get the offer. Maybe my investment isn't large enough to be worth asking about.

Maybe you have a margin account. In a margin account they can lend them without telling you, or paying you.

Similar threads

- Replies

- 10

- Views

- 1K

- Replies

- 6

- Views

- 677

- Replies

- 2

- Views

- 607

- Locked

- Replies

- 0

- Views

- 3K